Your Real-Time Pulse on the Talent Economy

Hiring is moving fast. So is the data.

The Talent Market Index (TMI) Live Briefings cut through the noise, delivering a clear, data-backed snapshot of what’s really happening in the job market—right now.

Register for the Talent Market Index Live Virtual Events

Watch the Latest Briefing

Updated monthly and powered by Recruitics’ proprietary performance data, the TMI helps talent leaders, marketers, and executives track demand and supply signals, media price trends, and shifting candidate behavior. It’s your cheat code for smarter strategy and faster decision-making.

The September 2025 Talent Market Index Release

The Labor Market Cools--But High-Skill Segments Are Still Heating Up

Key Findings:

- The longest job growth streak in U.S. history has ended: BLS revisions to June’s data erased previously reported gains, officially ending a 52-month expansion. August added just 22,000 jobs, the weakest print since the pandemic recovery began.

- Unemployment hit a post-pandemic high: The rate rose to 4.3%, the highest since October 2021, with the number of unemployed now exceeding available job openings—a reversal of the post-COVID labor tightness.

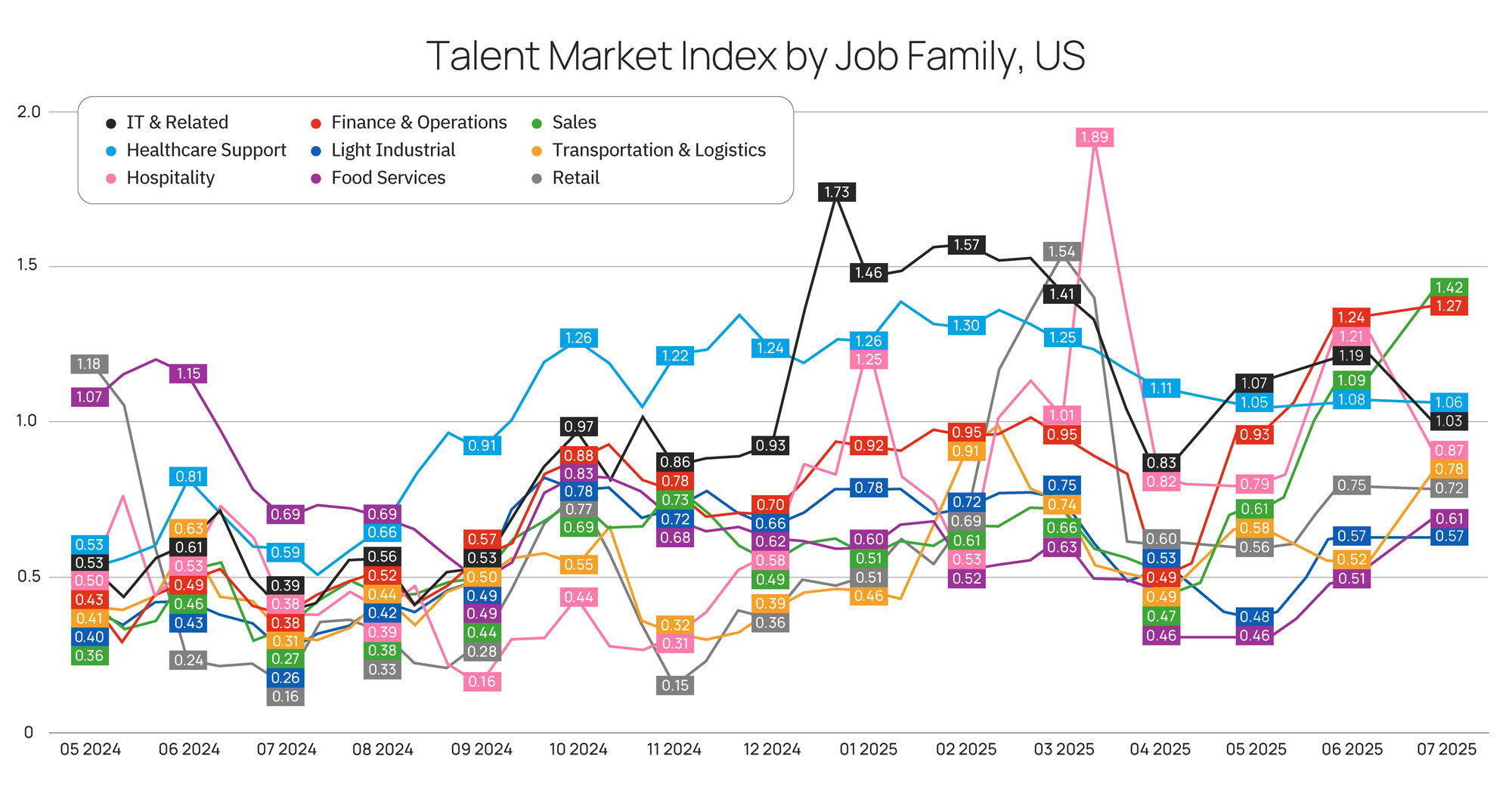

- Labor pricing trends are diverging: While overall demand is softening, 6 of 9 sectors in the Talent Market Index posted month-over-month price gains, led by Finance & Operations and Retail Trade—where strategic roles and seasonal spikes are pushing up attraction costs.

-

Pay is no longer outrunning inflation across most sectors: Only a few industries—Food Services and Leisure & Hospitality—are seeing wage growth that keeps pace with cost of living, underscoring the broader rebalancing in the labor market.

.png)

Finance & Operations

Leaner Hiring, but Price Pressure Builds at the Top

What’s Shaping the Market:

Finance & Operations roles shed 3,000 jobs in August 2025, down from a modest +11,000 in August 2024. But this contraction doesn’t mean demand is absent—it’s shifting upward, toward senior, strategic roles tied to compliance, transformation, and automation oversight.

Attraction prices are telling: they rose +9% month over month and are up a striking +52.8% year over year—making Finance & Ops one of the most expensive segments in the Talent Market Index this cycle.

Demand Is Rising Where Talent Is Scarce

- 87% of finance leaders now report a shortage of accounting and finance talent, up from 83% in 2024.

- The average number of open roles has doubled YoY, from 2 to 5 per organization, with 49% saying it takes 60+ days to fill high-skill positions.

- The pressure is most acute for roles that blend financial insight with operational agility—think FP&A leaders, transformation managers, and audit/compliance specialists.

Market Forces Behind the Spike

- Retirements and exits are shrinking the pool of experienced finance professionals, especially CPAs and controllers.

- Low entry into accounting tracks is limiting junior pipeline flow, compounding the gap at the mid-to-senior level.

- Meanwhile, AI adoption is increasing the need for talent who can bridge finance, data, and systems—a scarce combination driving premium pricing.

What This Means for You:

This is a costlier and slower market for high-skill finance talent—and not likely to ease soon. Employers should fast-track recruiting for strategic roles and invest in internal succession planning to reduce dependence on a tightening external market. For routine roles, clarity of scope and career growth pathways can help avoid wage inflation by default.

Healthcare

Still Carrying the Labor Market, But Slowing

What’s Shaping the Market:

Healthcare remains the most reliable engine of job creation, adding 30,600 jobs in August 2025. But even this resilient sector is showing signs of slowdown: monthly gains are down 57% from August 2024’s 71,000, pointing to a cooling cadence in an otherwise structurally tight labor market.

Attraction prices are up month-over-month (+22.43%), and down slightly year over year (-5.76%). Yet they remain well above the long-term baseline, reflecting sustained hiring pressure despite the deceleration in job growth.

Subsector Hotspots (and Soft Spots)

- Home health care services: +7,600 jobs — demand holds strong amid demographic trends and care model shifts.

- Ambulatory health care services: +12,800 — outpatient care continues to anchor job gains.

- Offices of physicians: +9,100 — steady, but slower than earlier this year.

- Offices of dentists: −3,800 — notable drop after months of modest growth; may signal softening demand or talent bottlenecks.

Structural Headwinds Are Building

- VA staffing crisis deepens: Nearly all VA hospitals report severe clinical shortages, raising pressure on adjacent systems to compete for the same limited pool.

- FTC targets non-competes in healthcare: New federal scrutiny could increase talent mobility—and attrition risk—for employers using restrictive covenants.

- Policy-driven caution in community care: Medicaid funding shifts and looming federal budget battles are causing hiring pullbacks in home- and community-based care settings.

- Burnout and labor unrest simmer: Rising union activity and staffing strain are prompting some systems to revisit compensation and retention models—especially in inpatient settings with chronic churn.

What This Means for You:

Budget stability may be masking deeper hiring risk. With prices holding steady but job creation slowing, now is the time to reinforce retention strategies and secure pipeline partnerships before the next wave of scarcity hits.

IT & Related

What’s Shaping the Market:

IT & Related roles saw a net loss of 5,000 jobs in August 2025, continuing a multi-month cooling trend. This marks a reversal from August 2024, when the sector still posted modest gains (+7,000). As digital transformation spending plateaus and employers reassess headcount after early-year overhiring, growth in tech-adjacent roles has clearly slowed.

Yet despite the job losses, this is one of only three sectors this month with a Talent Market Index above the baseline (1.09). Demand has evolved—concentrating around AI-specific talent and core infrastructure roles, rather than broad tech hiring.

Attraction prices remain relatively flat month over month and are down ~19% year over year, per the Talent Market Index—reflecting rebalanced supply-demand dynamics in a post-correction environment.

What This Means for You:

The tech hiring market has stabilized after last year’s correction, but demand is selective and role-specific. Employers should focus on targeted, value-driving roles (AI ops, cybersecurity, infrastructure modernization) rather than broad headcount expansion. For jobseekers, this is a market where skills specificity and adaptability matter more than ever.

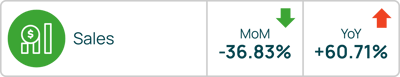

Sales

What’s Shaping the Market:

Sales roles saw net neutral job growth in August, continuing a plateau trend that started in Q2. The pullback is clearest in B2B and enterprise sales roles, where longer deal cycles and budget freezes are dampening expansion.

Attraction prices are down -37% MoM and +61% YoY, driven more by role complexity (strategic account management, revenue ops) than volume demand.

What This Means for You:

Hiring is more selective, not paused. If you're scaling sales teams, focus on revops fluency, cross-functional alignment, and upskilling your bench—especially as field roles become less prioritized than hybrid or strategic ones.

Transportation & Logistics

.png?width=400&height=77&name=Transportation%20September%202025%20(2).png)

What’s Shaping the Market:

Transportation & Logistics added just 2,500 jobs in August 2025, a marginal gain compared to +8,000 in August 2024. The sector remains supply-balanced, with no major hiring surges or contractions.

Attraction prices were up slightly (10%) month over month and up 100% year over year, suggesting labor supply and demand are largely in equilibrium—a rare stability in the current labor market.

What This Means for You:

This is a tactical hiring environment—costs are stable, but available talent is gravitating toward employers with predictable schedules, equipment reliability, and safety incentives. For seasonal or surge roles, streamlined onboarding remains a key advantage.

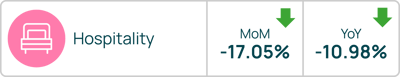

Hospitality

Hospitality continues to add jobs in 2025, but the pace is slowing. August saw 28,000 jobs added, down 39% from 46,000 in August 2024. The sector remains one of the few consistent contributors to job growth—but like others, it’s slowing.

Attraction prices are down (-17.05%) and down ~11% year over year, reflecting ample labor supply in most markets.

Soft Spots Emerging Beneath Summer Strength

- Domestic travel is driving demand: 71% of U.S. summer travel bookings were domestic, boosting hotel and restaurant activity in popular U.S. regions.

- International travel remains soft: Visitor spending is down ~3% YoY, and inbound tourist volumes are lagging due to visa backlogs and global uncertainty.

- Labor mismatches persist: Guest-facing roles (housekeeping, F&B, front desk) remain harder to fill in high-demand markets, despite national-level supply sufficiency.

What This Means for You:

With domestic demand holding steady, now is the time to prepare for the winter travel season—especially in regional and resort destinations. Align hiring strategies to local demand patterns, streamline applications for frontline seasonal roles, and consider flexible staffing models to manage unpredictable surges. Be cautious about overhiring for international volume—recovery remains slow, and most winter traffic will continue to come from U.S.-based travelers.

Light Industrial

What’s Shaping the Market:

Light Industrial roles added 4,100 jobs in August, nearly flat compared to +4,600 in August 2024. The slowdown in e-commerce fulfillment hiring is being offset by steady demand in warehousing and materials handling.

Attraction prices rose +26.% MoM and are down –4.2% YoY, signaling a cooler hiring climate than earlier in the cycle, but not a collapse.

What This Means for You:

Labor availability is improving in many regions, but rural and inland logistics zones still face constraints. Focus hiring resources where competition remains high and double down on safety, shift flexibility, and local partnerships.

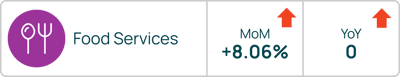

Food Services

What’s Shaping the Market:

Food Services added 12,500 jobs in August 2025, on par with +13,000 in August 2024. The sector continues to show seasonal hiring behavior, aligned with travel and event peaks.

Attraction prices were slightly up month over month and flat YoY, indicating that frontline labor availability has normalized—especially in metro and suburban markets.

What This Means for You:

Speed and consistency still win. Use high-conversion application formats (Easy Apply) and optimize shift scheduling and pay predictability to keep staffing levels stable—especially as competition for seasonal talent ramps back up heading into fall.

Retail

What’s Shaping the Market:

Retail lost 11,000 jobs in August 2024—but in August 2025 the story is very different. Despite an otherwise weak jobs report, retail posted gains, driven largely by general merchandise retailers. In other words: one of the few bright spots in a cooling labor market.

Roles like Sales Associate and Team Member ranked 6th and 7th among the most-posted job titles in August, confirming steady frontline demand. Over 50% of these postings used Easy Apply, boosting applicant conversion and expanding the talent pool. As a result, attraction prices remain stable, with no signs of a labor supply crunch. Unlike in healthcare, retailers can still fill roles without escalating wages.

Key Trends, Drivers & Headlines

-

Consumer Resilience amid Inflation: Inflation is still persistent—CPI rose ~2.9% YoY in August, with core inflation above 3% in some reports. But consumers appear to be adapting: as discretionary buckets cool, spending is shifting toward goods that offer perceived value or necessity. Discount and general merchandise retailers are benefiting.

-

Easing of consumer expectations: Sentiment surveys showed modest rises in perceived current economic conditions, which suggests households see some short‑term stability. That supports retail purchases in broad goods, especially value and essentials.

What This Means for Employers

Competitive advantage may lie in operational efficiency and cost control rather than aggressive wage premiums—for now. With labor supply more accessible in retail than in tight sectors, you can win via tight hiring, targeted incentives, scheduling clarity, and retention of hourly staff.

Looking Ahead: Labor Market Signals Through Fall 2025

Hiring Gets Smarter, Not Slower

As economic growth cools, companies are dialing up precision—focusing hiring on strategic roles (AI, finance, logistics) while consolidating legacy headcount.

AI Wage Gaps Widen

Expect continued upward pressure on pay for AI and cybersecurity talent. Premium roles could see another 5–8% hike by year-end as demand outpaces supply.

Seasonal Cycles Shorten

The back-to-school hiring peak will hit in July and fade by mid-August. Hospitality will stay active through early September—but only in high-demand regions.

Candidate Experience Will Decide Wins

Application flow is slowing. Conversion will depend on fast follow-up, flexible scheduling, and job ads that highlight growth—not just pay.

.png)

If you’d like to understand how these trends impact your company, explore our Strategic Consulting Services and connect with one of our experts for a tailored discussion.